Latest Insights on Cipla Share Price Trends

Introduction

The share price of Cipla, one of India’s leading pharmaceutical companies, has garnered significant attention in recent months. With the global pharmaceutical market expanding and evolving, understanding the factors affecting Cipla’s stock performance is crucial for investors and stakeholders alike.

Current Performance and Trends

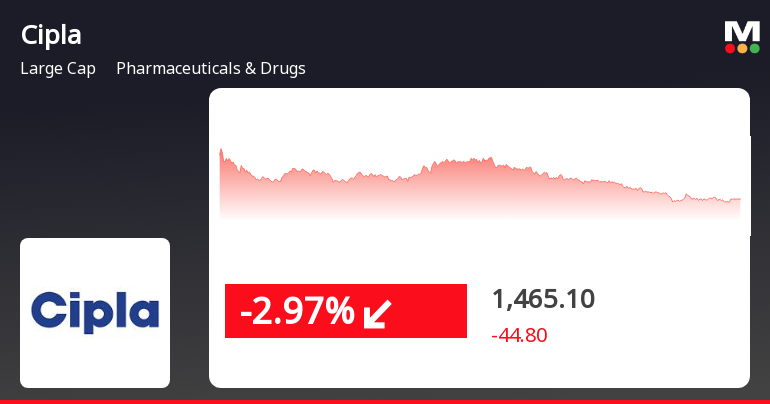

As of October 2023, Cipla’s share price has shown fluctuating trends amidst various market dynamics. The stock is currently valued at approximately INR 1,200 per share, reflecting a steady increase of 15% since the beginning of the year. This increase can be attributed to several factors, including robust quarterly earnings, strategic international partnerships, and an expanding product portfolio in key therapeutic areas.

In its latest earnings report, Cipla reported a 12% year-on-year growth in revenue, driven by strong sales in the chronic and acute therapeutic segments. Analysts point to the launch of new generic drugs and the company’s resilience in managing supply chain challenges as critical components of its current success.

Recent Developments

In September 2023, Cipla announced a collaborative agreement with a prominent biotech firm that aims to co-develop novel treatments for respiratory diseases. This partnership is expected to enhance Cipla’s presence in the rapidly evolving field of biologics, which is pivotal for long-term growth. Additionally, the company has announced plans to expand its manufacturing capabilities, signaling its commitment to meeting both domestic and international demand.

Investor Sentiment

Investor sentiment regarding Cipla shares remains largely optimistic. Many financial analysts have upgraded their ratings, citing the company’s strong fundamentals and positive growth prospects. The pharma sector is also experiencing heightened investor interest, given the increasing global health challenges and rising healthcare expenditures.

Conclusion

In summary, Cipla’s share price reflects its strategic initiatives and adaptability in a competitive pharmaceutical landscape. As the company continues to innovate and expand its market reach, investors can anticipate potential growth opportunities. Looking ahead, monitoring regulatory developments, market conditions, and Cipla’s ability to execute its strategic plans will be vital for understanding future share price movements. For current and prospective investors, staying informed will be key to making educated decisions regarding their investment in Cipla shares.