Latest Trends in Motilal Oswal Share Price

Introduction

Motilal Oswal Financial Services Limited, a prominent player in the Indian financial services sector, has been making headlines due to fluctuations in its share price. Understanding these trends is crucial for investors, traders, and market analysts as it reflects the company’s performance, investor sentiments, and potential future growth. As of recent trading sessions, the motilal oswal share price has witnessed significant changes, making it vital for stakeholders to stay informed.

Current Market Performance

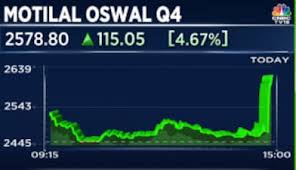

As of October 2023, the share price of Motilal Oswal has demonstrated volatility, influenced by various market factors. Recent reports indicate that the stock has seen an increase of nearly 5% over the past month, primarily driven by positive quarterly earnings, strong operational metrics, and favorable market conditions. Analysts attribute this surge to the company’s robust performance in wealth management and asset management services, which have gained traction amid increasing retail investor participation in the stock market.

On the other hand, the stock price has encountered resistance levels around INR 1000, with analysts suggesting that breaking this level could signal further upward movement. Conversely, should the stock fail to maintain its momentum, it may decline towards recent support levels.

Factors Influencing Share Price

Several macroeconomic factors and company-specific events influence the Motilal Oswal share price. The increasing interest rates and inflation could dampen market sentiment, which may affect investor behavior in the financial services sector. However, strategic initiatives taken by Motilal Oswal, including expanding its digital offerings and enhancing customer service, are perceived as positive moves that may stabilize and boost share prices in the long term.

Additionally, global market trends, including fluctuations in foreign investment and global financial stability, play a crucial role in determining stock performance. The ongoing geopolitical tensions and changes in policy by the Reserve Bank of India (RBI) also could potentially impact the financial markets overall, affecting the Motilal Oswal share price.

Conclusion

In conclusion, the motilal oswal share price is currently experiencing notable fluctuations that present both opportunities and risks for investors. Investors should closely monitor market conditions and company performance metrics while considering their investment strategies. The stock’s ability to break through current resistance levels could prove significant for its future trajectory. Keeping abreast of economic indicators and market sentiment is essential for anyone involved in trading or investing in Motilal Oswal shares. As the financial landscape evolves, it will be imperative for shareholders to stay informed and make educated decisions regarding their investments.