Nifty Achieves New All-Time High: What it Means for Investors

Introduction

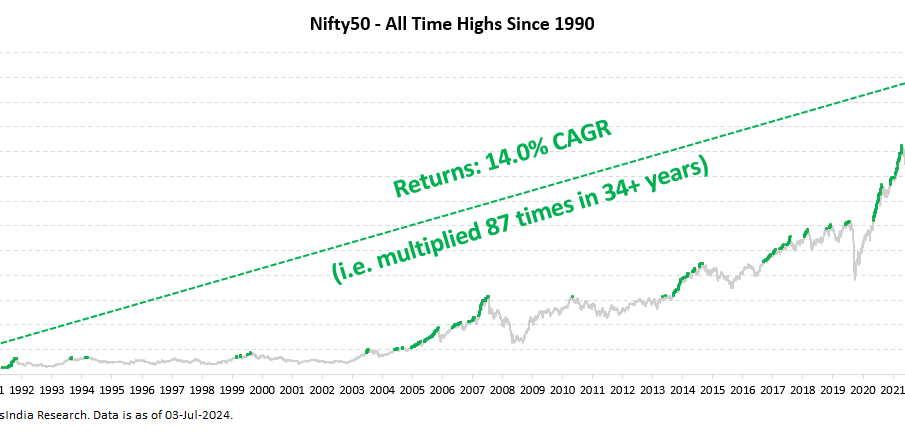

The National Stock Exchange’s Nifty 50 index has recently reached a historic milestone, hitting an all-time high. This significant achievement is not only a reflection of current market conditions but also a pivotal moment for investors and stakeholders within India’s financial ecosystem. As the Nifty crosses new thresholds, it raises questions about the factors contributing to this surge and what it means for the future of investments in India.

Market Performance and Factors Behind the Surge

As of October 2023, the Nifty 50 index soared beyond the previous record of 20,000 points, reaching an impressive 20,500 points. This remarkable performance can be attributed to various factors, including a rebound in consumer demand post-pandemic, favorable government policies, and a robust corporate earnings season where several listed companies reported record profits.

Analysts point to the healthcare, technology, and financial sectors as driving forces behind the stock market rally. The increased foreign direct investment (FDI) and a resilient GDP growth rate, projected at 6.5% for the current fiscal year, have also bolstered investor confidence. Furthermore, the easing of global supply chain constraints has led to an optimistic outlook for many sectors, contributing to the uptick in stock prices.

Implications for Investors

For retail and institutional investors, the Nifty’s all-time high presents both opportunities and challenges. On one hand, rising stock prices can mean substantial capital gains; on the other hand, it raises concerns about market corrections and overvaluation. Market experts advise investors to approach the situation with caution, emphasizing the importance of diversification and risk management.

Furthermore, with the Indian economic landscape evolving rapidly, sectors expected to perform well include renewable energy and technology, potentially providing new investment avenues. The bullish trend in the market suggests a favorable environment for long-term investing, but investors are urged to stay informed about macroeconomic indicators and market trends that could influence future performance.

Conclusion

The Nifty reaching an all-time high marks a significant milestone in India’s financial markets, reflecting both positive economic sentiment and the resilience of its corporate sector. While this may present lucrative opportunities for investors, it is crucial to remain vigilant and informed about the potential risks involved. As the market landscape continues to evolve, staying updated on economic developments will be essential for making informed investment decisions.