Understanding the Dow Jones Industrial Average: Importance and Trends

Introduction

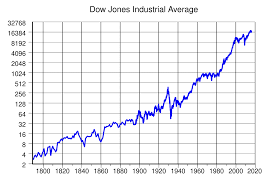

The Dow Jones Industrial Average (DJIA) is one of the most closely watched stock market indices in the world. It serves as a key indicator of the overall health of the U.S. economy and stock market, comprising 30 major companies from various sectors. With its historical significance and role in financial markets, understanding the DJIA can provide valuable insights into market trends and investor sentiment.

Current Trends in the Dow Jones

As of October 2023, the DJIA has shown signs of volatility influenced by economic data and geopolitical developments. Recently, the index experienced fluctuations due to concerns over inflation rates and Federal Reserve interest rate decisions. In September, the DJIA dropped by approximately 2% in response to reports highlighting rising consumer prices, prompting fears of prolonged economic tightening.

Investors are closely monitoring earnings reports from DJIA constituents, such as Apple, Boeing, and Goldman Sachs, which have a significant impact on the index’s performance. The third-quarter earnings season is set to begin, with market analysts projecting mixed results due to inflationary pressures and supply chain disruptions.

Significance of the DJIA

The Dow Jones Industrial Average is not just a measure of market performance; it’s considered a barometer of business health and market confidence. A rising DJIA often indicates a positive outlook among investors and can boost consumer confidence. Conversely, a falling index might signal economic uncertainty and declining corporate profitability.

Recent studies have also suggested a correlation between the DJIA and consumer spending patterns. As stock prices rise, consumers tend to feel more financially secure, which can lead to increased spending and, consequently, economic growth.

Conclusion

In summary, the Dow Jones Industrial Average remains a critical gauge for investors, economists, and policymakers alike. Its ongoing fluctuations reflect broader economic conditions and investor sentiment. As the U.S. economy continues to face challenges such as inflation and global uncertainties, keeping an eye on the DJIA will be instrumental for those looking to make informed investment decisions or understand market dynamics. The upcoming earnings reports and Federal Reserve announcements will likely shape the DJIA’s trajectory in the coming months, making it crucial for market watchers to stay updated on developments.