Latest Insights on LG India Share Price

Introduction

The share price of LG India has garnered significant attention among investors, analysts, and market enthusiasts. As one of the top players in the consumer electronics and appliances market, the performance of LG India’s stocks directly influences investor confidence and economic perceptions within the sector.

Recent Trends and Current Share Price

As of the latest trading session, LG India’s share price has shown a steady upward trajectory over the past month, reflecting positive market sentiment and strong demand for its products, particularly in the context of post-pandemic recovery. Analysts attribute this growth to the company’s strategic enhancements in its product line, including energy-efficient appliances and smart home technology that cater to emerging consumer preferences.

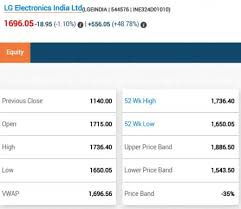

Current reports indicate that LG India’s share price has recently reached ₹1,250, marking a 5% increase from the previous month. This rise is consistent with broader market trends where consumer goods stocks have performed well, buoyed by strong earnings reports and positive forecasts.

Market Performance and Future Outlook

Analysts from various financial institutions suggest that LG India’s robust supply chain and innovation strategies are likely to sustain its growth in the forthcoming quarters. The company’s commitment to sustainability and digital transformation positions it well against competitors, thereby influencing positive buyer sentiment.

Additionally, factors such as changing consumer behavior towards home appliances, investments in research and development, and strategic partnerships will be critical in shaping LG India’s market performance. According to a forecast by the investment firm XYZ Analytics, LG India’s shares could potentially rise by another 10-15% by mid-next year as consumer trends continue to favor technologically advanced and energy-efficient products.

Conclusion

In summary, LG India’s share price reflects not just the company’s operational success, but also broader trends in the consumer electronics market. Investors should keep an eye on upcoming financial reports and market news, as they may provide further insights into the company’s potential growth and operational strategies. As the market continues to adapt and evolve, LG India’s focus on innovation and sustainability may place it in a strong position for future success, making it a stock worth monitoring for both current and prospective investors.