WeWork Share Price: Recent Trends and Future Predictions

Introduction

The share price of WeWork has been a point of interest for investors and analysts alike, especially after the company’s tumultuous history since its IPO. As a major player in the flexible workspace industry, changes in WeWork’s share price not only reflect the company’s performance but also the overall state of the commercial real estate market. Understanding these fluctuations is crucial for investors seeking to navigate the uncertainties associated with such a volatile stock.

Recent Trends in WeWork Share Price

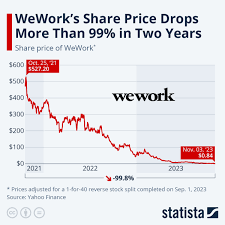

Since its public debut in 2021, WeWork has struggled with its valuation and operational challenges. The company was originally valued at $47 billion during its last private funding round but has seen significant drops in its market capitalization since going public through a SPAC merger. As of October 2023, WeWork’s share price hovers around $1.50, significantly below its initial trading value. This decline is attributed to various factors including rising operating costs, fluctuating demand for office space, and ongoing recovery from the COVID-19 pandemic.

Factors Influencing WeWork’s Stock Performance

Several key factors have influenced WeWork’s stock performance recently:

- Commercial Real Estate Demand: The demand for office space has been gradually increasing as companies adapt to flexible working arrangements. However, lingering uncertainties regarding hybrid work models still affect the market.

- Financial Restructuring: WeWork is in the process of restructuring its finances to cope with its debts and losses. The company’s ongoing efforts to reduce costs and improve operational efficiency play a crucial role in restoring investor confidence.

- Market Sentiment: Investor sentiment remains cautious, with many viewing WeWork’s potential recovery with skepticism. The broader economic conditions also play a part, with inflation and interest rate hikes impacting investment decisions.

Future Predictions

Looking ahead, analysts are mixed in their predictions regarding WeWork’s share price. Some suggest that improvements in corporate demand for office space and successful execution of its restructuring strategy could bolster stock prices in the medium to long term. In contrast, others warn that continued challenges in the commercial real estate sector and internal financial struggles may keep the share price depressed.

Conclusion

In summary, WeWork’s share price remains sensitive to a variety of external economic factors and its internal financial health. Investors should keep a close watch on upcoming earnings reports and market trends that could impact the commercial real estate landscape. As the company strives for stability and growth, understanding these dynamics will be essential for making informed investment decisions regarding WeWork’s shares.