Latest Trends in Canara Bank Share Price

Introduction

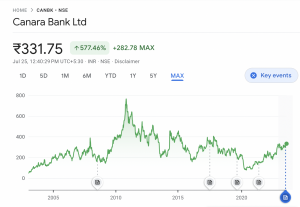

Canara Bank, one of India’s leading public sector banks, has seen considerable fluctuations in its share price in recent months. Understanding these trends is crucial for investors and stakeholders as it affects both investment decisions and overall market sentiment towards the banking sector.

Current Market Overview

As of October 2023, Canara Bank’s share price has shown resilience amid an evolving financial landscape characterized by changing interest rates and economic recovery post-COVID-19. The bank’s stock price currently hovers around ₹300, with analysts suggesting that its strong fundamentals and favorable market conditions could lead to potential growth.

Factors Influencing Share Price

Several factors contribute to the ongoing fluctuations in Canara Bank’s share price. The Reserve Bank of India’s monetary policy adjustments, specifically regarding interest rates, directly impact the bank’s lending and deposit rates, thereby influencing profitability and investor confidence. Moreover, Canara Bank’s robust asset quality, which has seen a reduction in non-performing assets (NPAs), further strengthens its position in the market.

Recent quarterly earnings reports also reflect a positive outlook, with a year-on-year increase in net profit helping to bolster investor optimism. The government’s support initiatives and the bank’s strategic focus on digital banking attract more customers, which may continue to enhance earnings and drive share prices upward.

Analysts’ Opinions

Financial experts predict a bullish trend for Canara Bank share prices over the next quarter, with many recommending it as a ‘buy’ due to its consistent performance and growth potential. They underline the importance of monitoring broader economic indicators and regulatory changes that could affect the banking sector overall.

Conclusion

In conclusion, Canara Bank’s share price continues to attract attention from investors as it embodies both the challenges and opportunities present in the banking sector. With strong management practices, improving asset quality, and a favorable economic environment, experts foresee continued positive momentum in the stock. Investors should, however, remain vigilant of global economic trends and internal developments within the bank to make informed investment decisions.