Understanding the Trends in Oracle Share Price

Introduction

The share price of Oracle Corporation has become a focal point for investors and analysts alike, especially as the technology sector continues to evolve rapidly. In a post-pandemic world, companies like Oracle are adapting to new market demands, and understanding the fluctuations in their share price holds significant relevance for investors looking to make informed decisions.

Recent Trends in Oracle Share Price

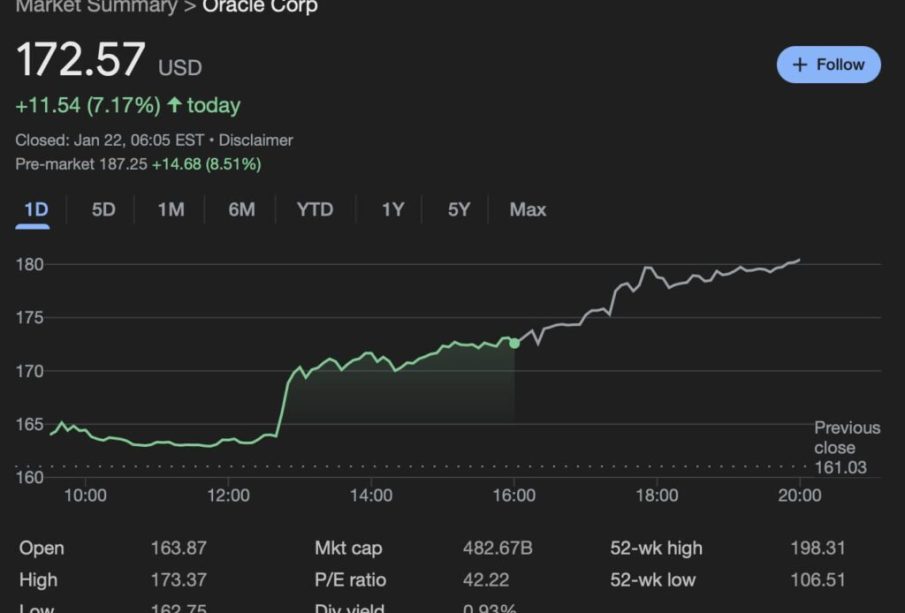

As of October 2023, Oracle’s share price has seen notable fluctuations influenced primarily by its recent quarterly earnings report, which demonstrated a commendable increase in cloud revenue. The report showed a growth rate of 30%, indicating strong demand for its cloud services. Following this announcement, the share price surged by approximately 8% in a single trading session, reaching a new high for the year. Analysts attribute this growth to Oracle’s strategic investments in cloud computing technologies and its ability to retain clients amidst competitive pressures.

Market Factors Influencing Share Price

Several external factors have also played a role in the affectation of Oracle’s stock. Rising interest rates have pressured most technology stocks, leading to increased scrutiny over profit margins and revenue growth. However, Oracle’s strong fundamentals have allowed it to navigate these challenges more effectively compared to its peers in the tech industry. Additionally, partnerships with key players in the industry and expansions into emerging markets have opened new revenue streams, contributing to its positive performance. Market analysts are optimistic about Oracle’s strategy, as solid fundamentals coupled with external growth opportunities have placed the company in an advantageous position.

Future Outlook

Looking ahead, analysts predict that Oracle’s share price will continue to grow, driven largely by its aggressive approach towards cloud technology. The ongoing digital transformation across industries presents an opportunity for Oracle to further solidify its market position. As enterprises move towards hybrid and multi-cloud environments, Oracle’s solutions are expected to become increasingly relevant. Furthermore, analysts recommend keeping an eye on the upcoming earnings reports and market announcements, as these events can significantly impact stock performance.

Conclusion

In conclusion, Oracle’s share price remains a critical indicator of its operational health and market position. While external economic factors pose challenges, the company’s strong performance in the cloud segment indicates a positive trend for its stock. Investors should remain informed about market dynamics and Oracle’s strategic initiatives as they navigate the evolving technology landscape. With the expected trends in its share price and continued growth potential, Oracle presents a compelling opportunity for investors.