Latest Trends and Insights on Coal India Share Performance

Introduction

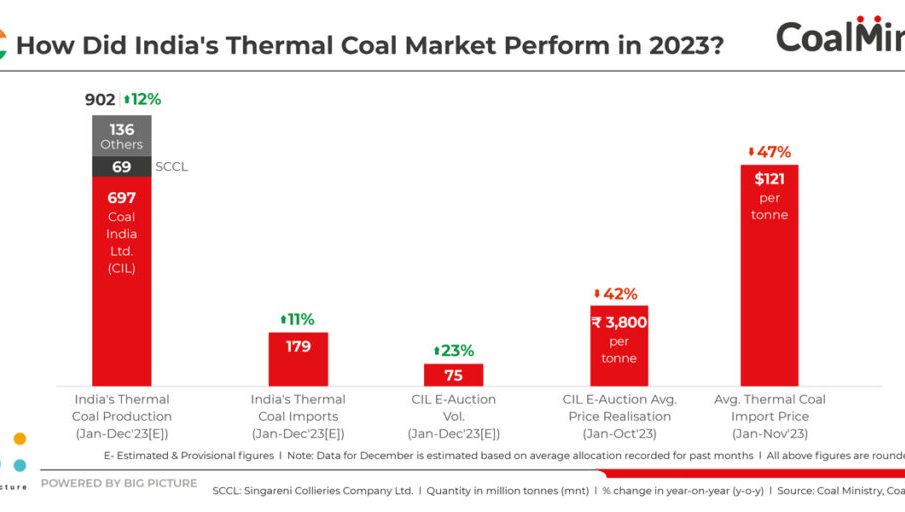

Coal India Limited (CIL) is the largest coal-producing company in the world, contributing over 80% of India’s total coal production. Therefore, its share performance is crucial not only for investors but also for the energy sector and the overall economy. In recent times, Coal India shares have attracted attention due to various factors, including government policies, environmental regulations, and market demand for coal.

Current Performance

As of October 2023, Coal India shares are trading at around ₹225 per share, showing a modest increase of approximately 4% over the last month. This rise is attributed to several factors, including a surge in coal prices on the international market and increased domestic demand due to the onset of the winter season.

Recent data indicates that coal prices have gained traction, reaching ₹5,900 per metric tonne, influenced by supply constraints and higher global demand as countries seek to ensure energy security. Moreover, CIL’s efforts to ramp up production to 700 million tonnes for the fiscal year 2024 has further increased investor confidence.

Government Policies and Regulations

The Indian government’s push towards energy security and the aim to reduce coal imports have positively impacted Coal India’s stock. In the latest budget, additional allocations for infrastructure development, particularly in coal-rich states, promise a smoother supply chain and enhanced transportation facilities.

However, environmental regulations and the push for renewable energy sources continue to pose challenges for coal producers. The government’s commitment to clean energy means that Coal India must balance its coal production with a sustainable approach.

Conclusion

For investors, Coal India shares represent an interesting opportunity, especially given the company’s dominant market position and significant government backing. However, potential volatility due to international energy prices and regulatory changes warrants cautious optimism. Analysts forecast that steady production growth and governmental support could lead to a bullish trend in the coal sector, particularly for Coal India.

In summary, while the coal market faces challenges ahead, Coal India remains a pivotal player in India’s energy landscape. Stakeholders and investors should monitor regulatory updates and market trends to make informed decisions regarding Coal India shares.