Latest Developments in UCO Bank Share Performance

Introduction

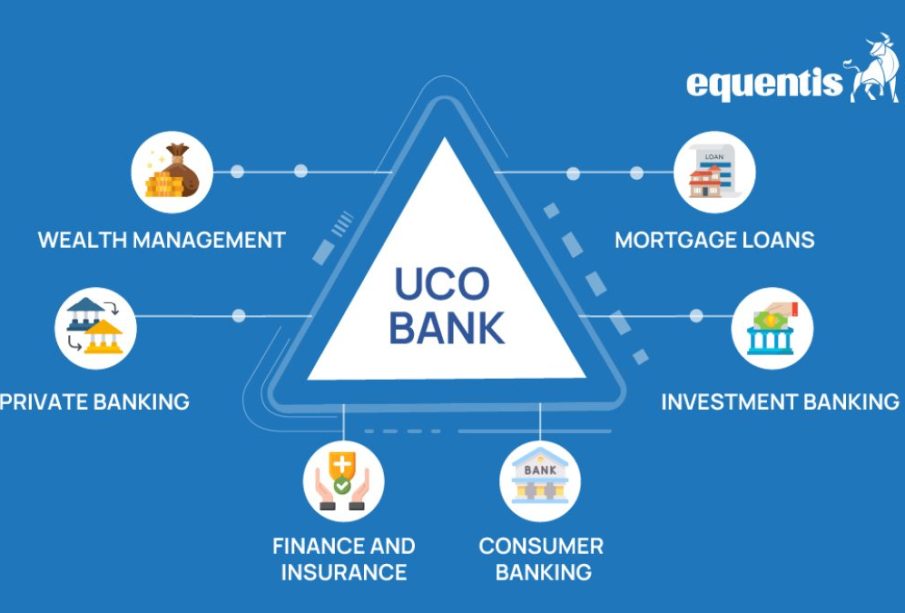

UCO Bank, a prominent player in the Indian banking sector, has gained considerable attention from investors recently. With its consistent performance and growth strategies, the bank’s shares have become a point of discussion among analysts and market participants. Understanding the share performance of UCO Bank is vital for current and prospective investors looking to navigate the complexities of the stock market.

Current Share Performance

As of October 2023, UCO Bank saw its shares trading at approximately INR 37, reflecting a stable growth trajectory. Over the past year, the shares have shown a remarkable recovery, with a significant increase of around 25% from last year’s performance. Analysts attribute this growth to the bank’s improved asset quality and enhanced focus on retail lending.

Factors Influencing UCO Bank Shares

Several key factors have contributed to the rising share prices of UCO Bank:

- Asset Quality Improvement: The bank has successfully reduced its non-performing assets (NPAs) ratio, which is crucial for building investor confidence.

- Growth in Retail Lending: UCO Bank’s strategy to expand its retail loan portfolio has resulted in increased interest income.

- Government Support: Being a public sector bank, UCO Bank has received substantial support from the government, ensuring financial stability and investor trust.

- Market Sentiment: The overall positive sentiment in the banking sector, especially post the recent reforms and economic recovery post-pandemic, has also played a role.

Future Outlook

Looking ahead, analysts remain cautiously optimistic about UCO Bank’s share performance. The bank’s focus on digital banking and improving customer service is expected to further bolstering growth. Potential investors should consider these factors while making investment decisions. Furthermore, upcoming government policies and economic conditions will play a significant role in shaping the future of UCO Bank’s stock.

Conclusion

In conclusion, UCO Bank’s share performance is indicative of its robust banking operations and strategic initiatives aimed at growth. As the bank continues to improve its performance metrics, investors may find UCO Bank shares to be an attractive option in their portfolios. Keeping abreast of market trends and internal bank developments will be crucial for making informed investment choices in the future.