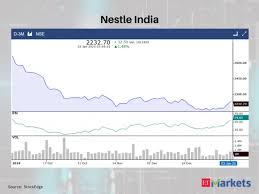

Recent Trends in Nestle India Share Price

Introduction

Nestle India, a subsidiary of the global food and beverage giant Nestle S.A., has been a significant player in the Indian market, known for its diverse product range and brand loyalty. The share price of Nestle India is closely monitored by investors and analysts alike, as it reflects the company’s financial health and investor sentiment. Understanding the trends and movements of Nestle India’s share price is essential for stakeholders looking to make informed investment decisions.

Current Performance

As of October 2023, Nestle India’s share price has shown noticeable fluctuations in response to various factors, including quarterly earnings reports, market conditions, and consumer demand trends. Recently, the company’s shares have seen an increase, driven by a strong quarterly performance that exceeded market expectations. The company reported a 15% year-over-year increase in net profit, strongly attributed to its successful product innovations and expanding distribution channels.

Market analysts have observed that the share price reached an all-time high of approximately ₹20,000 per share earlier this month. This peak was sparked by enhanced consumer spending and a growing interest in health-oriented products amid the ongoing shift in consumer preferences towards wellness-oriented food options.

Market Influences

The fluctuation in share price is often influenced by broader economic indicators, including inflation rates, commodity prices, and currency fluctuations. The increasing raw material costs have posed challenges for many food manufacturers, including Nestle. Despite this, the company’s strategic pricing and cost-management policies have helped to mitigate adverse impacts on its profitability.

Moreover, Nestle’s commitment to sustainability and innovation remains a key aspect of its growth strategy. The company’s initiatives aimed at enhancing eco-friendly packaging and reducing carbon footprints have not only attracted environmentally conscious consumers but have also contributed positively to its stock performance.

Outlook and Conclusion

Looking ahead, industry experts predict that Nestle India’s share price may continue to see upward momentum, especially if the company maintains its trajectory of innovation and consumer engagement. Additionally, ongoing investments in product development and expanding its market reach are expected to bolster its financial performance in the following quarters.

For investors, keeping a close watch on Nestle India’s quarterly results, market developments, and global economic trends will be crucial for making informed investment decisions. In conclusion, the share price of Nestle India not only reflects the company’s current standing but also serves as a barometer for the overall health of the fast-moving consumer goods sector in India.