Mazagon Dock Shipbuilders: Current Share Price Analysis

Introduction

Mazagon Dock Shipbuilders Limited (MDL) is a prominent player in India’s defense and shipbuilding sector, operating under the Ministry of Defence. The share price of Mazagon Dock is significant not only for investors but also for the larger context of India’s defense capabilities and the naval sector’s growth. With recent developments in the global and local markets affecting its valuation, monitoring the current share prices is crucial for stakeholders.

Current Share Price Trends

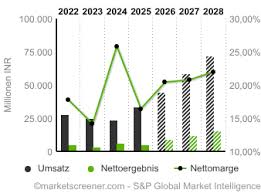

As of October 2023, the share price of Mazagon Dock is witnessing fluctuations amidst a variety of market factors. The stock is listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), making it accessible to a broad range of investors. Currently, shares are trading at approximately INR 420, which shows an increase of about 5% over the last month, driven by strong quarterly results and increased order bookings.

Market Performance and Influencing Factors

The increase in share price can be attributed to several recent factors. Firstly, the Indian government’s push for indigenous defense production has led to increased orders for naval ships and submarines. MDL recently reported securing a major contract, which is expected to contribute significantly to its revenue growth. Additionally, global supply chain improvements and better raw material availability have optimized production costs for MDL, further positively impacting its profitability.

Future Prospects

Looking ahead, analysts predict a continuous upward trend for the Mazagon Dock share price, especially with the Indian defense sector projected to grow significantly over the next decade. Investors are encouraged to keep tabs on MDL’s quarterly performance updates and any government announcements related to defense spending, as these will influence the company’s stock performance. The focus on modernization of the Indian Navy is expected to sustain demand for MDL’s services and products.

Conclusion

In conclusion, the share price of Mazagon Dock Shipbuilders reflects not just the company’s performance but also the overarching developments within India’s defense industry. With favorable government policies and increased demand for indigenous defense manufacturing, MDL’s future appears promising. Investors are advised to remain vigilant about market changes and company announcements that could affect the share price, as these insights will be essential for making informed investment decisions.