RBI MPC Meeting: Understanding the Repo Rate Decision

Introduction

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) meeting is an essential event for the Indian financial landscape. This gathering not only influences the country’s monetary policy but also has a direct impact on the economy by determining the repo rate, which affects borrowing and lending rates across financial institutions.

Recent Developments

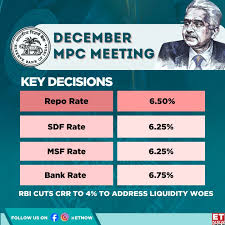

On October 6, 2023, the RBI’s MPC convened to deliberate on the country’s economic conditions and the appropriate monetary policy stance. The repo rate, which is the rate at which the RBI lends money to commercial banks, has a critical role in managing inflation and stimulating growth. Currently, the repo rate is set at 6.50%, a level maintained since the last hike in February 2023.

Factors Influencing the Decision

This meeting considered several factors, including persistent inflationary pressures and evolving global economic scenarios. Inflation has remained above the RBI’s comfort zone, often exceeding the 6% mark, driven by rising food and fuel prices. The committee discussed the need for a balanced approach to tackle inflation while supporting economic growth.

Reactions from Experts

Economists and market analysts have diverse opinions regarding the repo rate decision. Some suggest a hold on rates to monitor the impact of previous increases, while others advocate for a rate cut to spur consumer spending and investment in the uncertain economic climate. Industry stakeholders maintain that lower borrowing costs could boost the economy, especially for small and medium enterprises.

Conclusion

The outcome of the RBI MPC meeting has far-reaching implications for consumers, businesses, and the overall economy. The committee’s decision to maintain the repo rate signals a cautious approach towards monetary policy given the current economic indicators. Looking forward, experts anticipate that the RBI will closely monitor inflation trends and global economic developments, potentially leading to further adjustments in the coming months. Understanding these changes is crucial for stakeholders to navigate the financial landscape effectively.