Understanding Current PPF Interest Rates in India

Introduction

Public Provident Fund (PPF) is a long-term savings scheme backed by the Government of India, designed to provide investors with attractive interest rates and tax benefits. The PPF has garnered significant popularity among Indian citizens due to its low risk and high returns, making it an essential tool for retirement planning. Currently, the interest rates offered on PPF are crucial for both individual savers and financial planners as they impact savings growth and investment strategies.

Current PPF Interest Rates

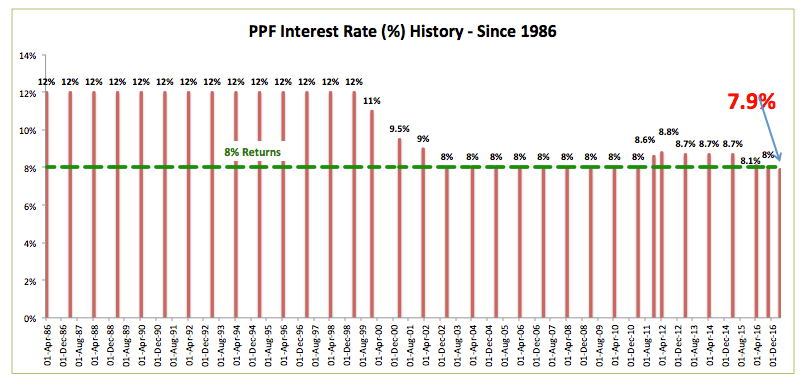

As of October 2023, the PPF interest rate stands at 7.1% per annum, as announced by the Ministry of Finance. This rate is fixed for a quarter and is revised periodically based on the prevailing yield on government securities. The interest is compounded annually and credited to the account at the end of the financial year, enhancing the savings over time.

Since the beginning of the fiscal year 2023-24, there have been no changes to the PPF interest rate, providing savers with a consistent and stable return. The interest rate is competitive when compared to other fixed-income investments such as fixed deposits and recurring deposits, offering a government-backed guarantee that appeals to risk-averse investors.

Factors Influencing PPF Interest Rates

Several factors can influence PPF interest rates. These include:

- Government Securities Yield: The interest rates are aligned with the yield on government securities and are adjusted by the government to maintain economic stability.

- Inflation Rates: High inflation may lead to increased interest rates to encourage savings, while low inflation may have the opposite effect.

- Economic Policy Changes: Fiscal policies and budget announcements by the government can impact PPF interest rates directly.

Benefits of Investing in PPF

Investing in the PPF offers several key benefits:

- Tax Benefits: Contributions to PPF are eligible for tax deductions under Section 80C of the Income Tax Act, encouraging savings.

- Loan Facility: After the completion of certain lock-in periods, investors can take loans against their PPF balance.

- Long-Term Investment: The PPF has a lock-in period of 15 years, which helps in cultivating a disciplined saving habit.

Conclusion

The PPF continues to be an attractive savings instrument for many Indians, with its stable interest rates and government backing ensuring security for long-term investments. With the current interest rate at 7.1%, savers can expect their investments to grow satisfactorily over time. As the economy evolves, potential investors should keep a close eye on government announcements regarding future interest rates, as these will impact personal finance strategies moving forward. Overall, PPF remains a cornerstone of many financial plans, promoting both savings and wealth accumulation.