Seshaasai Technologies IPO: A New Chapter in Tech Sector

Introduction

The initial public offering (IPO) of Seshaasai Technologies has become a focal point of discussion among investors and analysts in the Indian stock market. With a growing emphasis on technology and innovation in the country, the IPO signifies not only a financial opportunity but also a shift towards technological advancement in various industries.

Details of the IPO

Seshaasai Technologies, a leading provider of intelligent automation solutions, announced its public offering initially targeting to raise approximately ₹300 crores. The IPO comprises fresh issuance of equity and an offer for sale by existing shareholders. The company has set a price band between ₹100 to ₹150 per share, aiming to attract a broad range of investors.

Market Reactions and Investor Interest

Since the announcement, market responses have been overwhelmingly positive, with preliminary demand indicating that the IPO could be oversubscribed. Analysts believe that Seshaasai’s innovative product offerings, especially in AI-driven solutions and digital transformation services, position it favorably in a rapidly evolving tech landscape. This has led to heightened interest from retail and institutional investors alike.

Company’s Growth Prospects

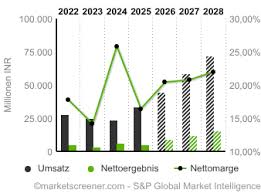

Seshaasai Technologies reported a robust financial performance over the past fiscal year, with a revenue growth of 35% year-on-year. The firm has positioned itself as a key player in sectors such as finance, healthcare, and telecommunications, where automation and efficiency are paramount. As businesses increasingly adopt digital solutions, Seshaasai is poised to capture a larger market share, making this IPO a potentially lucrative investment.

Conclusion

The Seshaasai Technologies IPO is not just an opportunity to invest in a promising tech company; it is a reflection of the broader trends in the Indian economy where technology plays a crucial role in shaping future growth. If the current momentum continues, industry experts predict that Seshaasai could set a precedent for future tech IPOs, influencing both investor sentiment and market dynamics going forward. Investors should closely monitor this IPO and assess their options, keeping in mind the company’s strategic plans and market conditions.