Adani Total Gas Share Price: Latest Trends and Analysis

Introduction

The share price of Adani Total Gas has been a focal point for investors in the Indian stock market, particularly in the wake of growing interest in the renewable energy sector. As one of the leading companies in the gas distribution sector, fluctuations in its stock can have significant implications for both investors and market observers alike. Understanding the recent trends in Adani Total Gas share price is essential for making informed investment decisions.

Current Market Trends

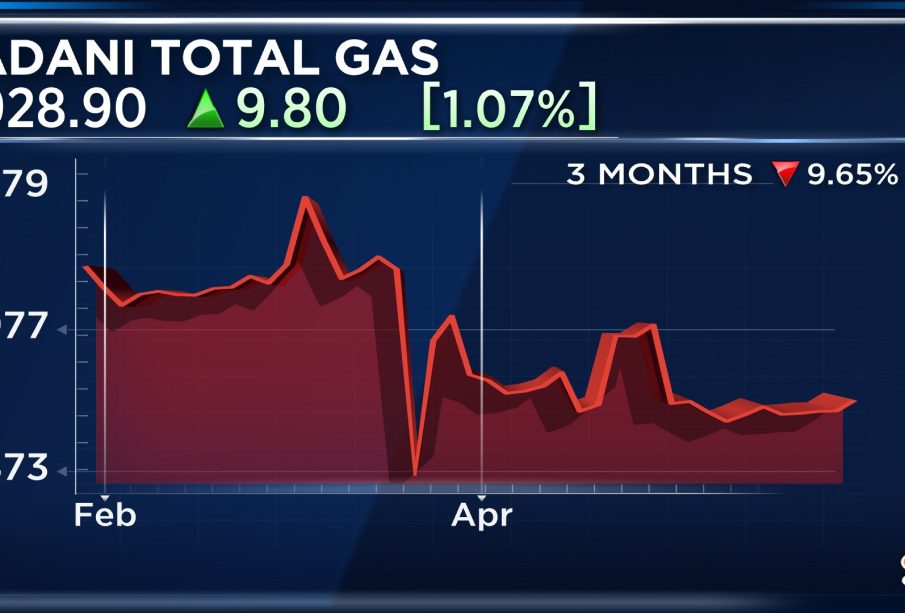

As of October 2023, the Adani Total Gas share price has experienced considerable volatility. After climbing rapidly to reach an all-time high of ₹3,700 in July 2023, the stock has seen fluctuations due to various external and internal factors. Recent analysis suggests that global energy prices, regulatory changes in gas distribution, and the company’s financial performance played critical roles in influencing the share price.

Factors Influencing Share Price

Several indicators have contributed to the recent changes in the Adani Total Gas share price:

- Global Energy Market Dynamics: The ongoing shifts in global oil and gas prices have a direct impact on local markets, affecting investor sentiment regarding future profitability.

- Regulatory Changes: Amendments to government regulations in the energy sector, aimed at promoting clean energy, could either positively or negatively affect the market perception of companies like Adani Total Gas.

- Company Financial Performance: The quarterly reports detailing revenue growth and cost management strategies are closely monitored by investors. The latest quarterly results have shown promising growth but also highlighted challenges that could impact future earnings.

Investor Sentiment and Analysis

Investor sentiment around Adani Total Gas remains cautiously optimistic. Analysts have mixed forecasts, with some suggesting potential growth due to expanding infrastructure projects and others warning of risks from market volatility and competition. Consequently, many investors find themselves assessing whether to hold their shares or explore buying opportunities at lower price points.

Conclusion

The Adani Total Gas share price remains a critical point of interest in the Indian stock market as the company navigates both opportunities and challenges in a dynamic energy landscape. Investors should keep a close eye on market trends, regulatory developments, and the company’s financial health to make informed decisions. Moving forward, analysts predict that the share price will continue to be influenced by external market conditions and internal operational strategies, making it essential for stakeholders to stay updated with the latest information.