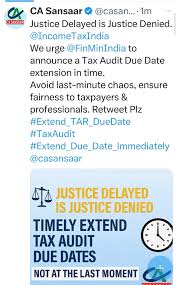

Understanding the Tax Audit Date Extension in India

Importance of Tax Audit Date Extension

Tax audits are a critical component of India’s financial system, ensuring compliance and accountability among businesses and individual taxpayers. The government periodically assesses the need for tax audits to enhance transparency and efficiency. Recent developments have highlighted the relevance of tax audit date extension, which can significantly affect compliance deadlines for taxpayers.

Recent Developments

In September 2023, the Income Tax Department announced an extension for tax audit filings for the financial year 2022-2023. The original deadline of September 30, 2023, has been extended to October 31, 2023. This extension is particularly beneficial for small and medium enterprises (SMEs) and individuals who may struggle to complete their required audits amidst numerous compliance requirements.

According to official reports, the decision to extend the deadline was influenced by several factors, including feedback from tax professionals and challenges posed by recent economic changes. The extension aims to alleviate pressure on taxpayers who may need additional time to prepare necessary documentation and ensure accuracy in their submissions.

Implications for Taxpayers

The extended deadline offers several implications for taxpayers. Firstly, it provides individuals and businesses with more time to gather relevant financial documents, thereby reducing the likelihood of errors that could arise from rushed submissions. Secondly, it allows taxpayers to better understand their tax obligations and seek professional advice if needed, thus promoting compliance and reducing disputes with authorities.

Conclusion

As the deadline approaches, taxpayers are encouraged to take advantage of the additional time provided by the tax audit date extension. It is crucial for individuals and businesses to stay informed about their obligations and utilize the opportunity to ensure comprehensive and accurate tax submissions. Looking ahead, such extensions may continue to be an essential tool for the government to improve tax compliance and provide necessary support to the taxpayer community. Staying engaged with official updates will help ensure that taxpayers can navigate the audit process smoothly and responsibly.