Current Trends in Adani Energy Solutions Share Price

Importance of Adani Energy Solutions in the Market

Adani Energy Solutions, a key player in India’s energy sector, has garnered significant attention in the stock market due to its rapid growth and strategic initiatives. As the world shifts towards sustainable energy, the company’s innovation and investments in renewable resources have made it a focal point for investors.

Recent Share Price Developments

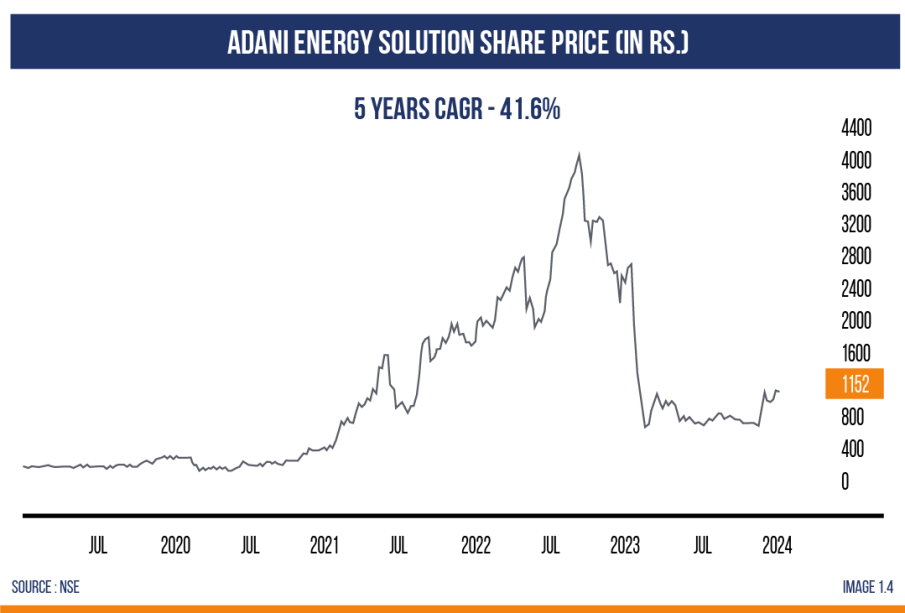

As of mid-October 2023, the share price of Adani Energy Solutions has experienced notable fluctuations. Initially valued at INR 1,500 per share earlier in the month, the price dipped to INR 1,350 amidst broader market corrections influenced by global economic uncertainties, including rising inflation rates and geopolitical tensions. However, analysts have indicated a potential rebound, with projections estimating the price could rise as high as INR 1,700 by the end of the quarter, propelled by the company’s recent announcements regarding new renewable projects.

Factors Influencing the Share Price

Several factors are currently influencing the share price of Adani Energy Solutions. The company’s aggressive expansion plan in the renewable sector is a significant driver. Recently, Adani announced an investment of INR 50,000 crore over the next five years towards solar and wind energy projects. Additionally, strategic partnerships with international firms for technology transfer and implementation are poised to enhance the company’s operational efficiency and further solidify its market position.

Moreover, government policies favoring renewable energy development and the increasing demand for clean energy are expected to provide a positive backdrop for Adani’s growth, thereby affecting its share price positively in the coming months. Institutional investments and retail participation have also surged, indicating a sustained interest from the market.

Conclusion and Forecast

In conclusion, while the past few weeks have shown volatility in Adani Energy Solutions’ share price, the overall long-term outlook remains optimistic. Investors are encouraged to monitor upcoming announcements and market trends closely. If the company successfully executes its growth strategies, it could lead to a substantial increase in its share price, making it an attractive option for investors looking to enter the renewable energy space.

As the demand for sustainable energy solutions grows, Adani Energy Solutions is well-positioned to capitalize on this trend, suggesting that current fluctuations may present a buying opportunity for forward-looking investors.