Cochin Shipyard Share Price: Current Trends and Analysis

Introduction

The Cochin Shipyard Limited, a leading public sector shipbuilding and repair yard in India, holds significant importance in the maritime sector. Given its contributions to the Indian Navy and commercial shipping, the share price of Cochin Shipyard is closely monitored by investors and analysts alike. Keeping track of its market performance provides insight into not just the company’s growth, but also the health of the broader shipping and defense sectors.

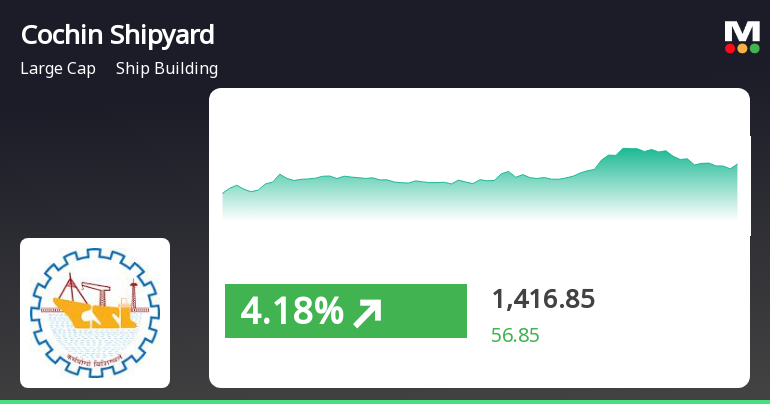

Current Share Price Analysis

As of October 2023, the share price of Cochin Shipyard has shown notable fluctuations. On the National Stock Exchange (NSE), shares were trading at ₹530, reflecting a moderate increase of 3% over the past two weeks. This steady rise can be attributed to favorable quarterly results announced in August and an increase in defense spending by the government, which has positioned the company favorably for upcoming projects.

Factors Influencing the Stock

Several factors have led to the increased interest in Cochin Shipyard stock. First, the company’s performance in securing contracts for shipbuilding and repair has been impressive, with recent contracts from the Indian Navy for the construction of advanced vessel types. Furthermore, the government’s focus on “Atmanirbhar Bharat” (self-reliant India) has led to increased investments in domestic manufacturing capabilities. Analysts predict that if this trend continues, Cochin Shipyard may witness further growth in revenue and profitability, positively impacting its share price.

Moreover, the global shipping industry is recovering post-pandemic, resulting in higher demand for vessels. This resurgence is expected to boost the order book for Cochin Shipyard, contributing to a positive outlook on share prices in the coming quarters.

Conclusion

In conclusion, the Cochin Shipyard share price reflects broader trends in the maritime and defense sectors, and it is poised for growth based on current market dynamics. Investors should keep an eye on upcoming quarterly results and government policies affecting the defense sector. With the resurgence in demand for naval capabilities and domestic manufacturing, Cochin Shipyard appears to be poised for a promising investment journey. Regular updates and analyses are crucial for making informed investment decisions.