Understanding India VIX: A Key Indicator of Market Volatility

Introduction

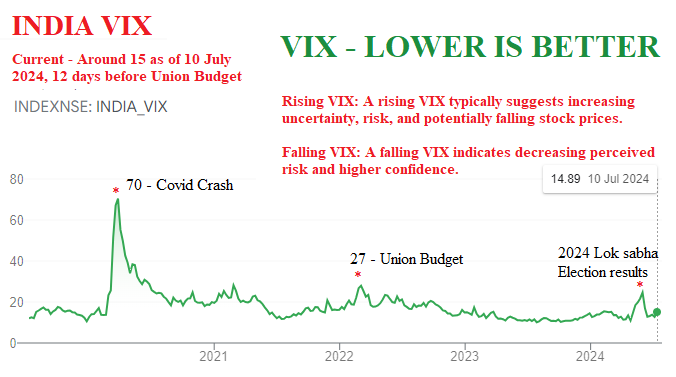

India VIX, also known as the Volatility Index, is a vital measure of the expected volatility in the Indian stock market. It serves as a benchmark for investors and traders to gauge market sentiment and potential price fluctuations in Nifty 50 stocks. A rising VIX generally signals higher expected volatility and investor fear, while a lower VIX indicates stability and investor confidence.

The Importance of India VIX

Understanding India VIX is crucial for both institutional and retail investors. It not only helps in assessing market sentiment but also guides investment decisions based on the expected level of risk. For example, during periods of economic uncertainty or political turbulence, the India VIX tends to rise as investors seek to hedge against potential losses. Recent historical events, such as the COVID-19 pandemic and geopolitical tensions, have led to significant fluctuations in the index, making it a focal point for market analysis.

Current Trends and Events

As of October 2023, the India VIX is trading at around 18.5, which signifies a moderate level of market anxiety. This level comes after a series of volatility spikes earlier this year, driven by fluctuating inflation rates, changes in interest policies from the Reserve Bank of India, and global economic concerns. Analysts suggest that the India VIX could stay within this range unless influenced by major economic developments or political decisions affecting the markets.

Forecast and Significance

Looking ahead, many analysts predict that the India VIX may experience periods of volatility in line with ongoing global economic uncertainties and domestic policy changes. Factors such as upcoming elections, reforms, and international trade relations will play a crucial role in shaping the market sentiment reflected by the India VIX. For investors, monitoring the index is essential for making informed decisions regarding entry and exit strategies in the stock market.

Conclusion

In summary, India VIX is an essential tool for anyone interested in the Indian stock market. It provides critical insights into market sentiment and anticipated volatility, allowing investors to prepare for potential market movements. As financial markets continue to be influenced by various factors, keeping an eye on the India VIX can be a strategic advantage for making investment decisions.