Current Status and Factors Influencing BEL Share Price

Introduction

Investment in shares is a significant avenue for wealth creation in India, and one of the stocks gaining attention recently is the BEL (Bharat Electronics Limited) share price. BEL plays a crucial role in the defense sector, supplying high-tech electronics products to the Indian armed forces. Understanding its share performance is vital for investors, as it reflects not only the company’s financial health but also the broader economic and geopolitical landscape.

Recent Developments

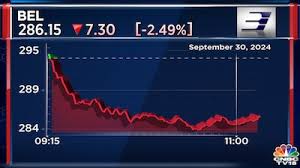

As of October 23, 2023, the BEL share price has seen fluctuations, trading at around ₹90 per share. Over the past month, the stock has shown resilience, which has attracted both institutional and retail investors. The company reported a robust Q2 FY2024 earnings result in early October, showcasing a revenue growth of 15% compared to the previous quarter, primarily due to rising defense orders and an increase in electronics demand.

Analysts attribute this positive trend to the government’s increased budget allocation for defense spending and initiatives aimed at promoting local manufacturing under the ‘Make in India’ campaign. The management’s focus on expanding their product portfolio, particularly in the field of radar and electronic warfare systems, has also bolstered investor confidence.

Market Analysis

Investor sentiment around BEL is further supported by a favorable macroeconomic environment. The Indian stock market as a whole has been performing well, with the Sensex reaching new heights in recent months. Moreover, the ongoing geopolitical tensions in the region have heightened the demand for defense and security solutions, benefiting companies like BEL.

However, potential investors should remain cautious. Global supply chain challenges and rising material costs could impact profit margins. Market analysts suggest that while short-term gains are encouraging, investors should consider the long-term implications of policy changes and global economic conditions influencing the defense sector.

Conclusion

The BEL share price will continue to be influenced by various factors, including government spending on defense, overall economic conditions, and company performance. For current and potential investors, keeping an eye on these developments can provide a clearer picture of what to expect from BEL in the coming months. As the defense industry evolves and adapts to new challenges, BEL is likely to remain a significant player, making its share price a topic of interest for many in the investment community.