Understanding the Latest MCX Share Price Trends

Introduction

The Multi Commodity Exchange of India Ltd. (MCX) has been a significant player in the Indian commodity market since its inception in 2003. As a leading commodity exchange, the share price of MCX is closely monitored by investors and market analysts alike. Understanding MCX share price trends is crucial as it can provide insights into the overall health of the commodity market in India, influencing both short-term trading strategies and long-term investments.

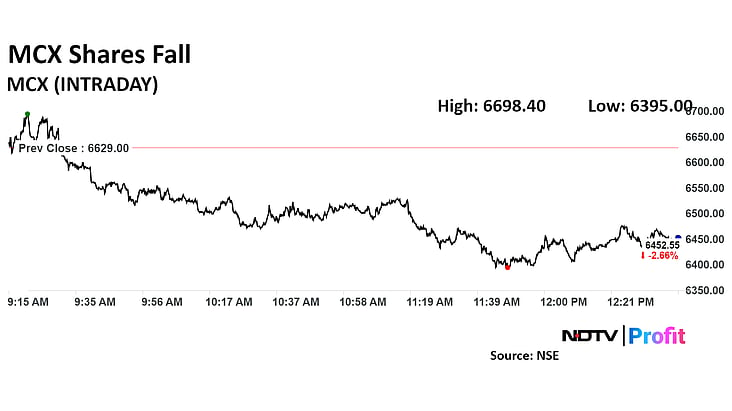

Current Share Price Overview

As of October 2023, MCX shares have seen a fluctuation in their price due to varying market dynamics. The latest reports indicate that the share price is trading around ₹1730, reflecting a slight increase compared to the previous month. This change is attributed to a combination of factors, including increasing trading volumes, higher global commodity prices, and investor sentiment reacting positively to recent regulatory changes.

Market Influencers

Several factors are contributing to the current performance of MCX share prices:

- Global Commodity Prices: With rising prices in international oil and metal markets, MCX has benefited from increased trading activities.

- Regulatory Changes: Recent government initiatives aimed at promoting commodity trading have positively affected market perception.

- Economic Recovery: As India’s economy shows signs of recovery post-pandemic, demand for commodities has risen, further boosting MCX’s trading volumes.

Investor Sentiment

Analysts suggest that investor sentiment remains bullish for MCX shares, particularly given the increasing interest among retail investors in commodities trading. The robust growth in volumes and revenues has attracted institutional investments as well, strengthening the stock’s position in the marketplace.

Future Projections

Looking ahead, analysts forecast that MCX share prices could experience continued growth in the upcoming quarters. With the Indian government focusing on enhancing the agricultural sector and increasing exports, this will further buoy the demand for commodities. Furthermore, advancements in technology may lead to more efficient trading systems, making it easier for investors to participate.

Conclusion

In conclusion, the MCX share price reflects a dynamic intersection of various market factors and trends. As retail and institutional interest in commodities continues to surge, investors should keep a close eye on price movements and market signals. The outlook for MCX appears positive, emphasizing the opportunity for investors looking to capitalize on the potential growth within India’s commodity market.