Current Trends in Anant Raj Share Price

Introduction

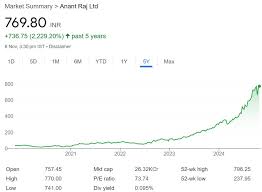

The share price of Anant Raj, a prominent player in the Indian real estate sector, has garnered significant attention from investors and market analysts alike. Understanding the fluctuations in Anant Raj’s share price is crucial for stakeholders and potential investors who wish to make informed decisions. Given the resurgence in the real estate market post-pandemic, evaluating the share price trends of Anant Raj is particularly relevant.

Current Market Performance

As of October 2023, Anant Raj’s share price has seen a notable uptrend, currently trading at INR 85, reflecting a surge of approximately 15% over the past month. This increase can largely be attributed to various factors, including strong quarterly earnings reports and positive market sentiment regarding the real estate sector’s revival. Analysts suggest that the company’s strategic focus on residential and commercial real estate projects has paid off, resulting in higher demand for their shares.

In recent developments, Anant Raj has announced several new projects in key urban areas, which are expected to drive future revenue growth. Furthermore, the government’s push for infrastructure development and affordable housing schemes has created a conducive environment for real estate growth, benefitting companies like Anant Raj.

Market Sentiment and Forecast

Investor sentiment towards Anant Raj has remained bullish, with many analysts predicting a further rise in its share price. The company has been actively engaging with its stakeholders, ensuring transparency and consistent communication regarding its business strategies and valuations.

Furthermore, some market experts believe that if Anant Raj continues to successfully execute its project plans and deliver on financial results, we could see its share price touch the INR 100 mark within the next quarter. However, it is important for investors to remain cautious, as real estate is highly sensitive to economic changes and regulatory policies.

Conclusion

The Anant Raj share price is currently on an upward trajectory, fueled by strategic growth initiatives and a positive outlook for the Indian real estate sector. Investors keen on entering or expanding within this space should monitor market trends closely while considering potential risks. As the company continues to navigate a competitive landscape, the coming months will be pivotal in determining the sustainability of this growth and the overall health of its share price.