Unveiling Ashneer Grover’s Net Worth in 2023

Introduction

Ashneer Grover, the co-founder of BharatPe, has become a prominent figure in India’s fintech landscape. His innovative contributions to digital payments have revolutionized the financial sector. Understanding Grover’s net worth not only highlights his personal success but also reflects the booming startup culture in India. As of 2023, Grover’s net worth is estimated to be around ₹2,800 crores, making him one of the richest entrepreneurs in the country.

Main Body

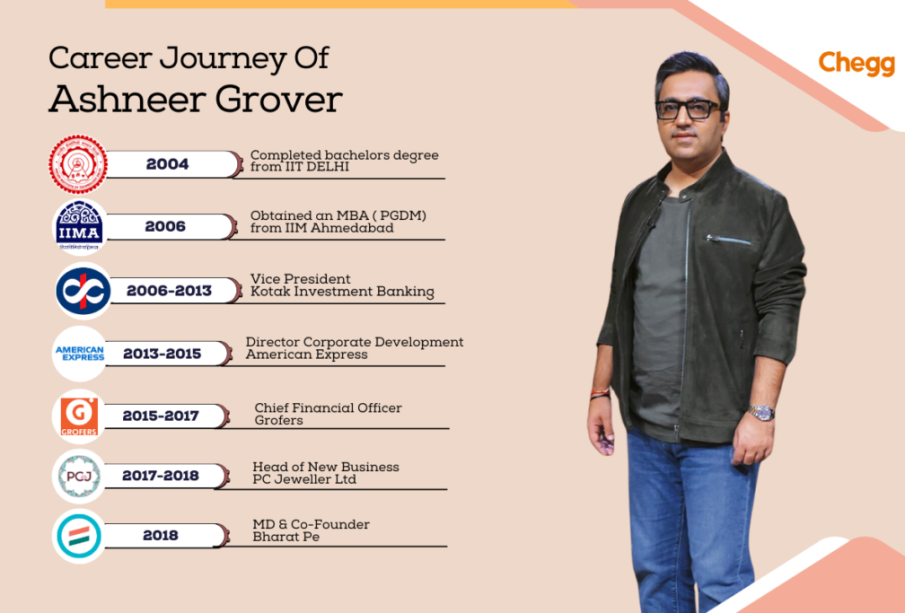

Born in 1982 in Delhi, Grover attended the Indian Institute of Technology (IIT) Delhi, where he graduated with a degree in Civil Engineering and later acquired an MBA from the Indian Institute of Management (IIM) Ahmedabad. His career began at prestigious firms like Kotak Investment Bank and then moved to the US to work at companies such as the consulting firm, The Boston Consulting Group.

In 2018, he co-founded BharatPe, a company that enables merchants to accept payments via UPI. Under his leadership, BharatPe quickly scaled and gained recognition for its unique approach to financial services, which included lending to small merchants and offering investment products. The company has raised multiple funding rounds from high-profile investors, boosting its valuation significantly. By 2021, BharatPe achieved a valuation of $2.85 billion.

Despite facing controversies and scrutiny in recent times, Grover’s entrepreneurial spirit remains strong. In early 2022, he was at the center of a public dispute regarding his exit from BharatPe, leading to discussions about governance in startups. Nevertheless, his influence and expertise have left a lasting impact on the fintech industry, inspiring other emerging startups.

Conclusion

Ashneer Grover’s estimated net worth of ₹2,800 crores speaks volumes about his achievements in a relatively short span of time. As India continues to embrace digital innovation, Grover’s story serves as an example of how entrepreneurs can navigate challenges and capitalize on opportunities. For readers, understanding his financial journey could provide insights into the evolving landscape of Indian startups, reinforcing the significance of innovation and resilience in the entrepreneurial ecosystem.